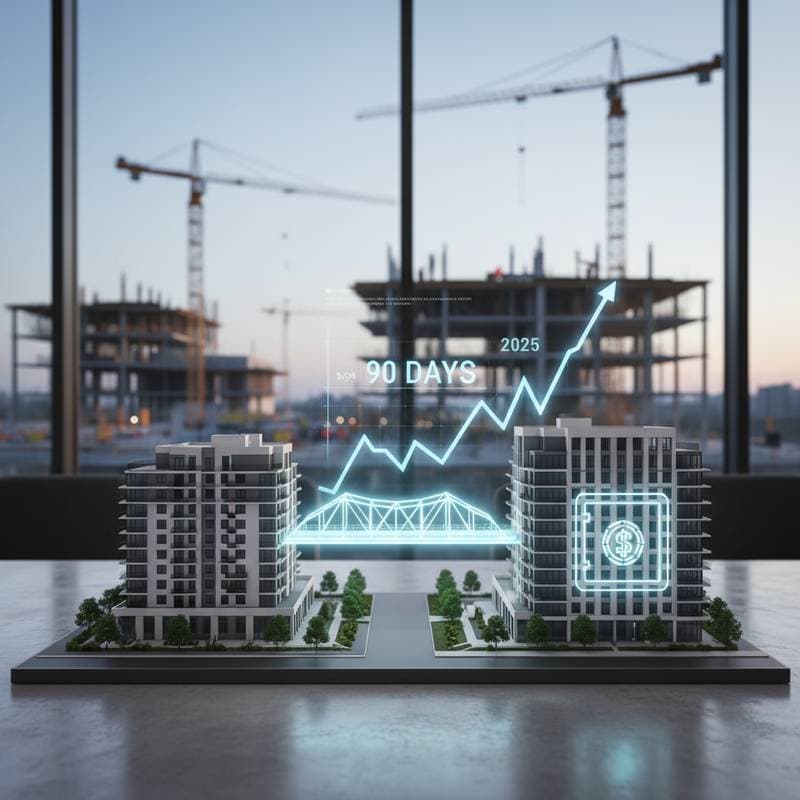

90-Day Bridge Loans Keep Construction Moving Forward

90-day bridge loans revolutionize construction by delivering rapid funding that bridges cash gaps, sustains project momentum, and cuts delay costs. Ideal for builders handling dynamic schedules, these loans offer swift approvals and adaptable terms to drive consistent progress across multiple sites.